Protecting yourself from Vanguard's poor security practices

The index fund company Vanguard supports two-factor authentication (2fa) with SMS. SMS is known to be the worst form of 2fa, because it is vulnerable to so-called SIM-swapping attacks. In this type of attack, the malicious party impersonates you and tells your telephone company you’ve lost your SIM card. They request that your number be moved to a new SIM card that they possess. The attacker could call up the company and ask them to activate a spare SIM card that they’ve acquired earlier, or they could visit a store and ask to be given a new SIM card for your number. Then they can receive your security codes.

The security of SMS-based 2fa is only as good as your phone operator’s protections against SIM-swapping, meaning probably not very good. The attacker only needs to convince one mall telco shop employee that they’re you, and they can likely try as many times as they want.

Vanguard claims to also support hardware security keys as a second factor. These are widely regarded as the gold standard for 2fa. Not only are they a true piece of hardware that can’t be SIM-swapped, they also ensure you’re protected even if you get fooled by a phishing attempt (by sending a code that is a function of the URL you are on).

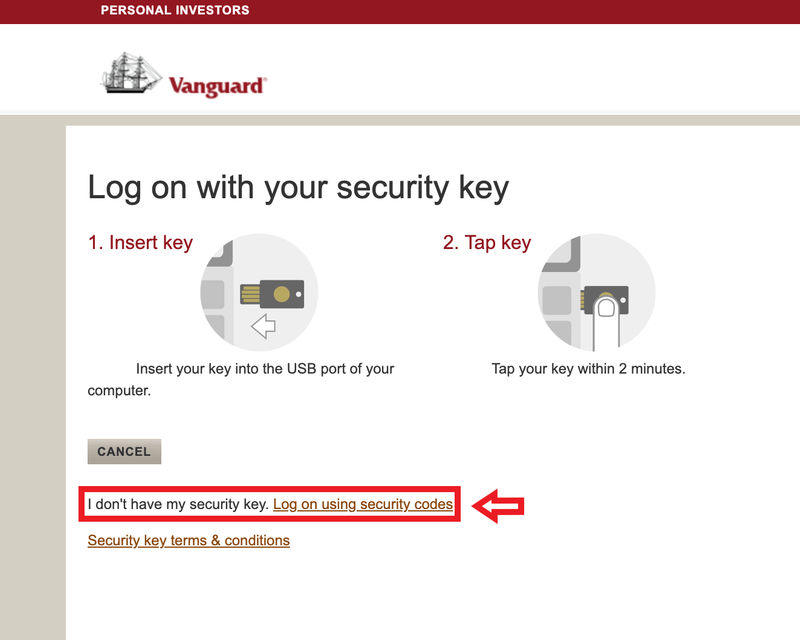

So good news, right? No, because Vanguard made the inexplicable decision to force everyone who uses a security key to also keep SMS 2fa enabled as a fallback option. This utterly defeats the point. The attacker can just click ‘lost security key’ and get an SMS code instead. Users who enable the security key feature actually make their account less secure, because it now has two possible attack surfaces instead of one.

People have been complaining about this for years, ever since Vanguard first introduced security keys. On the Bogleheads forum (where intense Vanguard fanatics congregate), this issue was recognized in this thread from 2016, this one from 2017, this one from 2018, and several others. There are plenty of complaints on reddit too. It’s fair to assume some of these people will have contacted Vanguard directly too.

It’s disappointing that a company with over 6 trillion dollars of assets under management offers its clients a security “feature” that makes their accounts less secure.

The workaround I’ve found is to use a Google Voice number to receive SMS 2fa codes (don’t bother with the useless security key). Of course, you must set the Google Voice number not to forward SMS messages to your main phone number, which would defeat the purpose. Then, the messages can only be read by being logged in to the Google account. A Google account can be made into an extremely hardened target. The advanced protection program is available for the sufficiently paranoid.

If you don’t receive the SMS for some reason, you can also receive the authentication code with an automated call to the same number.

You need to have an existing US phone number to create a Google Voice account.

By the way, using Google Voice may not work for all companies that force you to use SMS 2fa. I have verified that it works for Vanguard. This poster claims that “many financial institutions will now only send their 2FA codes to true mobile phone numbers. Google Voice numbers are land lines, with the text messaging function spliced on via a third-party messaging gateway”.